Understanding Medicare Benefits

Medicare Basics

Health care is an area of major political and economic debate, and many of these laws may be substantially altered in light of potential legislative changes, coupled with the enormous fiscal challenges the current programs like Medicare & Medicaid face. Still it is important that soon to be retirees familiarize themselves with the basic rules surrounding Medicare.

Medicare is the largest insurance provider in the United States and currently serves as the primary insurance by law for the vast majority of citizens over the age of 65. Should you opt to work fulltime beyond the age of 65, you can choose not to opt into medicare and stay with your employer based plan. In the year 2012 the annual premium payments can range from slightly less than $100 per month to more than $300.00 per month depending on your annual income. The premium payments will ordinarily be debited directly from your Social Security benefits. Although you have the option to enroll in Social Security benefits early at age 62, you may not enroll in Medicare prior to age 65 unless you’re deemed to be disabled by Social Security. In such a case in which you qualify for Social Security disability insurance (SSDI), you will automatically qualify for early Medicare benefits early. No additional proof of disability is required.

Part A…Medicare is broken down into multiple parts. The first part is Medicare part A. Part A is the basic hospitalization portion of Medicare. In some circumstances Part A will cover a skilled nursing home facility and or hospice care. Medicare part A has no premium costs as long as you paid Medicare taxes for a minimum of 10 years prior to enrolling. However, there is a deductible of just over $1,100.00 that must be met for hospital stays less than 60 days. Hospital stays between 61-90 days are $283 per day. And hospital stays between 91-150 days are $578 per day.

Part B…Medicare part B is designed to provide coverage for doctor visits, outpatient treatments, blood work/lab tests, medical supplies/equipment, ambulatory care and various other treatments. Part B is subject to the monthly premium ranges stated above.

Medicare typically covers 80% of the above referenced expenses after deductibles are met. In cases in which an individual does not have a separate health insurance plan in place for retirement, it is a wise choice to consider a supplemental plan, also known as Medigap coverage. These policies can range quite a bit in premiums and should be researched based on your area and zip code. One place to start to screen providers is directly through the Medicare website listed below. These policies will base your premium on a more traditional form of underwriting that considers your health status and & gender.

http://www.medicare.gov/find-a-plan/questions/medigap-home.aspx

In some cases your former employer may have provided you with the option of continuing your health insurance into retirement. In most of these cases there is a premium associated with that benefit. Such a benefit would then serve as your supplemental insurance. Most of these employer based plans have premiums no more than a typical premium for a Medigap policy, which can cost close to $500 per month for a couple. However, in the event that your employer plan premiums should run higher than the cost of a Medigap policy, it is still a wise choice keep it in force. Medigap, is a “gap” coverage for the uncovered 20% of costs. Yet your employer plan may coordinate benefits to an even higher rate should you need to be seen by someone outside the Medicare network. At onetime this was not much of a concern. However, in recent years many medical professionals have been opting out of Medicare due to lower and lower reimbursement rates. Doctors can choose to be participating, non-participating or opt out. Should a specialist you may need to see be an “opt out” doctor, it is helpful to have a more complete back up coverage that they may accept rather than be completely liable for the bill yourself.

Medicare Part C…Part C is known as Medicare Advantage or managed care. Part C will typically have a set premium with lower deductibles or no deductible. It is purchased through a private insurance company and allows you to combine parts A, B & D into one singular policy which can work like and HMO or PPO type plan. One benefit is that when you utilize a managed care plan, unlike a supplemental plan that stands independent, your policy premiums will not vary based on age or health status. All participants in your state selecting the same plan will pay the same premium.

Part D… Medicare Part D is the prescription drug portion of Medicare. This must be purchased separately unless you have a former employer plan that covers this expense or you have chosen to incorporate this into Part C in a managed care plan. These plans are bought separately through a private insurer where you can select a policy that best meets your needs. The premiums can vary widely depending on the level of coverage you select and the type of deductible and copay arrangements agreed upon. This is where the famous donut hole in coverage exist, were you hit a maximum benefit in the plan and coverage ends until you exceed another deductible and policy benefits begin again often at a reduced amount. It is important to research your plan features before you select a Part D provider. It is possible to research these for the state you reside in by contacting your states Health Insurance Assistance Program (SHIP Office).

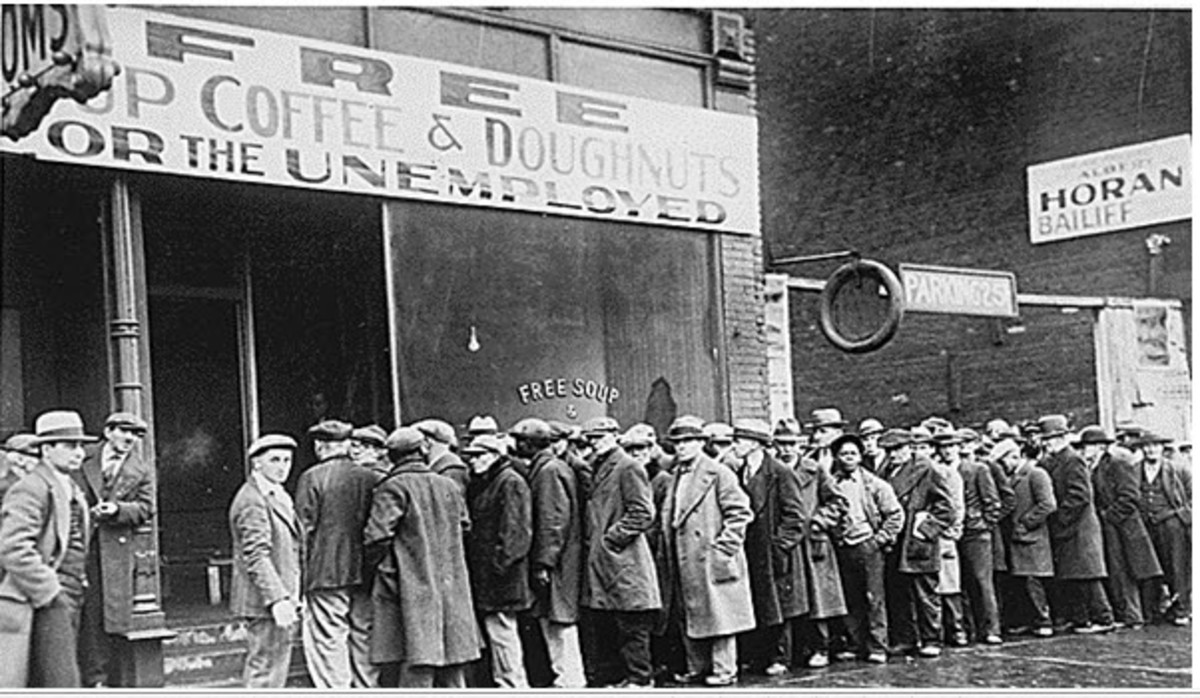

As mentioned earlier, Medicare currently faces some enormous fiscal challenges. U.S. entitlement programs now account for nearly 2/3rd’s of the Federal budget. As a result, it is highly likely that these programs will change substantially in the future. It is important for each retiree to be aware of the changes as they happen so that you can adapt to see what is the best solution is for you.

Suggested Reading

- Should I Pay off My Mortgage Early ???

For many Americans, the ability to pay down their mortgage sooner is simply not realistic. However in some cases it is quite possible. The Question of whether or not you should accelerate mortgage payments or use liquid cash to eliminate the... - Financial Planning for Widows

Over the many years I have worked in the field of financial planning, I have noticed that I have worked with a fairly disproportionate number of clients whom are widows. While this was not by design, it has allowed me to acquire some insight into... - What should your Financial Advisor ask you ???

Often we read articles & commentary about what to ask your financial advisor. But what should your financial advisor be asking you. Often times that alone can tell you whether or not you are engaged in a financial advisory relationship that is in - The Impact of Retirement Distributions in Volatile M...

Over the last fifteen years in the financial planning field, the most commonly expressed concern I have heard from a retiree/pending retiree has been…Will I run out of money ??? When examining this question there are many variables to be concerned... - What Are The Hidden Costs of Mutual Funds ???

When it comes to analyzing mutual fund fees, you most often have to turn over more than a few stones to find them all. Mutual funds costs can be broken down into three basic categories. Load funds, no-load funds and no-load funds with a transaction.. - Bonds vs Bond Funds ???

While over the years the community of investment professionals nearly universally agree that most every client should own some form and percentage of fixed income as part of their asset allocation strategy…Over the years there has been an ongoing... - The Case for Alternative Investment Strategies

One of the lessons of 2008, and even the more recent market volatility is that portfolio management has become more dynamic. Traditional asset allocation models of equities, fixed income, and cash equivalents may not be sufficient for more growth... - The Importance of Asset Allocation

When building and investment strategy we often hear the term “diversification” Yet and equally important concept is “Asset Allocation” It has been shown via numerous studies that the proper allocation can account for better than 90% of long... - Understanding Annuities

What is an annuity ??? Annuities can generally be summarized as two basic types of insurance contracts. They are either immediate or deferred annuities. Over the years these two types of contracts have been expanded to encompass many different... - Long Term Disability: Important Aspects

Many of us do not always recognize the potential danger of becoming permanently disabled. The U.S. Census says that you have about a 1 out of 5 chance of becoming disabled for at least a period of time. The average duration for a long term...